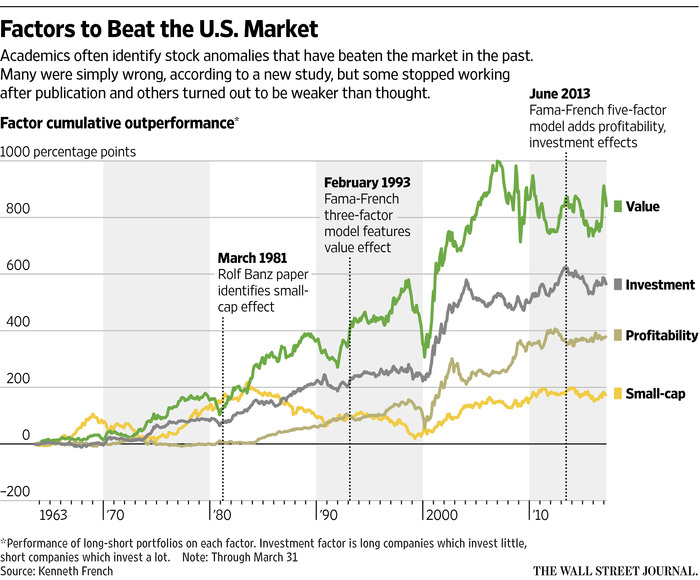

A recent study has come out that postulated that most market anomalies, ie, small-cap stocks outperforming large-cap stocks, are either too small to matter, or have already been exploited and so are no longer valid. The existence of market anomalies does not make sense, in theory, for efficient markets, because the price of a security is likely to be close to its intrinsic value. This is a reason why it is so difficult for active managers to outperform on a long-term basis, both before and after fees. If the anomaly exists, it is likely that multiple algorithms will detect it, and the anomaly will quickly be exploited and cease to exist. Read on to determine what the impact of some so-called anomalies is for smart-beta ETFs.