When the going gets tough, it is OK to go slow and watch your footing. You don’t want to fall and roll down the mountain. You keep hearing about how this is the bull market people love to hate. When I hear that, I just have to shake my head. The S&P is the same as it was 19 months ago. I don’t like the value. People say earnings will grow because they’re coming off a relatively low base. The guess for 2017 is 15% earnings growth. But how in the world can earnings go up if nominal GDP is rising by less than wages? Profit margins must be squeezed. I’m not so sure that we’ll get some big bounce in earnings, particularly after Brexit.

This Barron's article from March 26, 2016 gives a brief description of how you should allocate your portfolio for the long term. As you will see, the top 40 U.S. banks have differing opinions on what the proper allocation is. In the end, it's all about doing whatever you are comfortable with.

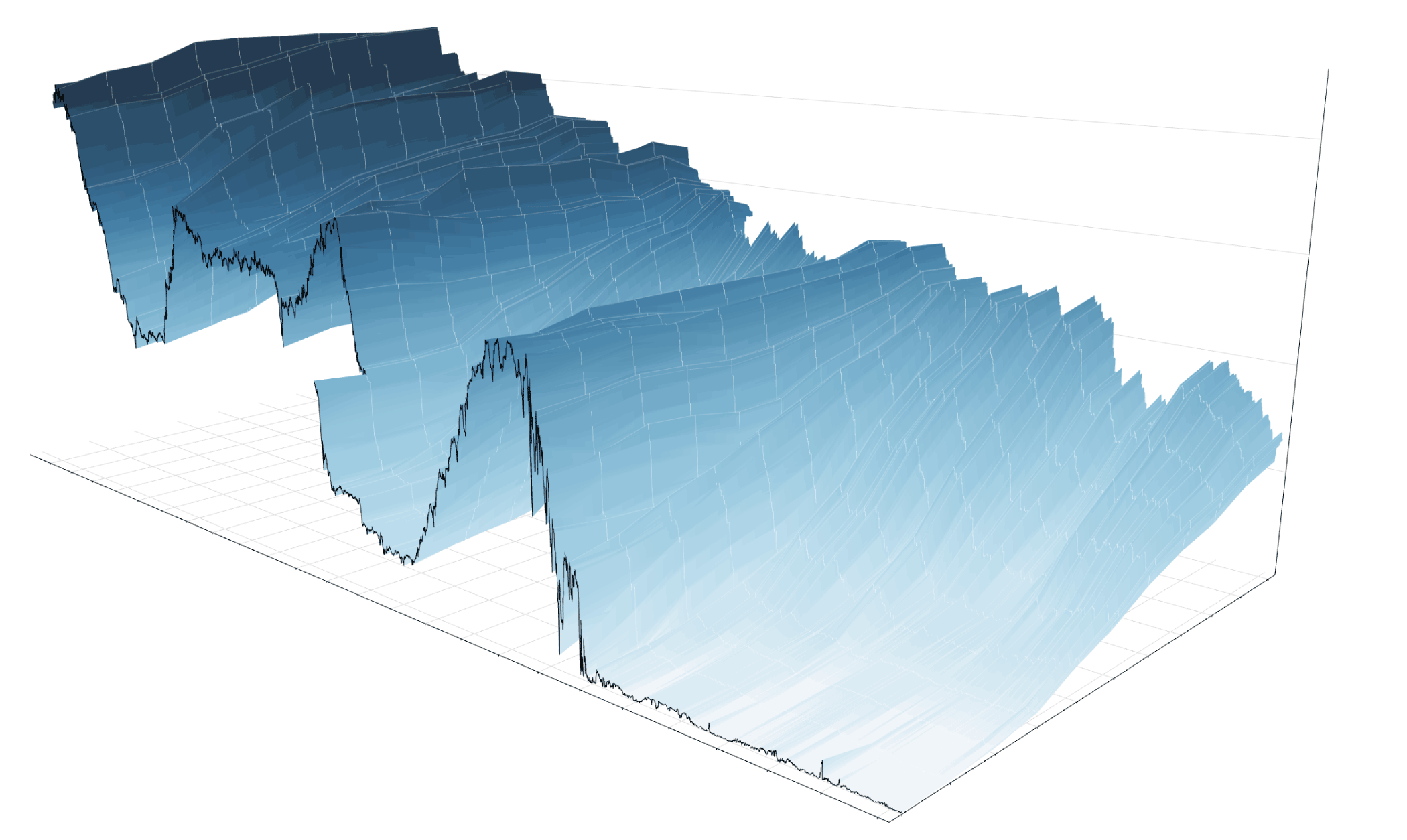

Yield curve 101

The yield curve shows how much it costs the federal government to borrow money for a given amount of time, revealing the relationship between long- and short-term interest rates.

It is, inherently, a forecast for what the economy holds in the future — how much inflation there will be, for example, and how healthy growth will be over the years ahead — all embodied in the price of money today, tomorrow and many years from now.

About once per year, Barron's has an in-depth article comparing major brokerage firms. Take a look to see how yours compares for infrequent traders, frequent traders, options, fees, and research. Take a look to see how yours compares for infrequent traders, frequent traders, options, fees, and research.

Click here to go to the Barron's article from March 22, 2016.